Children's Taxable Account

-

TokyoBoglehead

- Veteran

- Posts: 791

- Joined: Thu Jul 07, 2022 10:37 am

Children's Taxable Account

We are fortunate to have been able to complete our J-Nisa contributions.

Child 1 - 4 years

Child 2 - 1 Year

It seems the restrictions on Child's taxable accounts makes them a pretty undesirable vehicle. There only real utility is to allow you to invest your "child's money" for them.

Unless your relatives are handing out 1.1 million to each individual to avoid tax, or your child has been gifted money directly for college, there not much reason to use it

Thoughts? Am I missing something here?

Child 1 - 4 years

Child 2 - 1 Year

It seems the restrictions on Child's taxable accounts makes them a pretty undesirable vehicle. There only real utility is to allow you to invest your "child's money" for them.

Unless your relatives are handing out 1.1 million to each individual to avoid tax, or your child has been gifted money directly for college, there not much reason to use it

Thoughts? Am I missing something here?

- RetireJapan

- Site Admin

- Posts: 4424

- Joined: Wed Aug 02, 2017 6:57 am

- Location: Sendai

- Contact:

Re: Children's Taxable Account

Giving money regularly to reduce potential inheritance or gift taxes later.

Child can invest the money and let it compound.

Otherwise, no?

Child can invest the money and let it compound.

Otherwise, no?

English teacher and writer. RetireJapan founder. Avid reader.

eMaxis Slim Shady

eMaxis Slim Shady

-

sutebayashi

- Veteran

- Posts: 628

- Joined: Tue Nov 07, 2017 2:29 pm

Re: Children's Taxable Account

> Unless your relatives are handing out 1.1 million to each individual to avoid tax

Commendable legal behaviour

>, or your child has been gifted money directly for college, there not much reason to use it

There are these 学資保険 products out there (I saw Kanpo running TV CMs this week actually), which to my mind are an almost a scam.

Much better to invest that money directly on behalf of the kid for their education, in a tax free JNISA.

With JNISA ending though, it seems like a plain old 名義預金 to me, potentially, but planning to use it as intended.

Commendable legal behaviour

>, or your child has been gifted money directly for college, there not much reason to use it

There are these 学資保険 products out there (I saw Kanpo running TV CMs this week actually), which to my mind are an almost a scam.

Much better to invest that money directly on behalf of the kid for their education, in a tax free JNISA.

With JNISA ending though, it seems like a plain old 名義預金 to me, potentially, but planning to use it as intended.

-

TokyoBoglehead

- Veteran

- Posts: 791

- Joined: Thu Jul 07, 2022 10:37 am

Re: Children's Taxable Account

The government doesn't like it, it's true.sutebayashi wrote: ↑Fri May 19, 2023 12:16 pm > Unless your relatives are handing out 1.1 million to each individual to avoid tax

Commendable legal behaviour

>, or your child has been gifted money directly for college, there not much reason to use it

There are these 学資保険 products out there (I saw Kanpo running TV CMs this week actually), which to my mind are an almost a scam.

Much better to invest that money directly on behalf of the kid for their education, in a tax free JNISA.

With JNISA ending though, it seems like a plain old 名義預金 to me, potentially, but planning to use it as intended.

The current rule is any gift given 3 years before the givers death will be taxed.

The plan is to change this to 7 years.

My mother-in-law, bless her heart, hates this and want to avoid all unnecessary taxes on her future estate. She's a pragmatic women.

-

sutebayashi

- Veteran

- Posts: 628

- Joined: Tue Nov 07, 2017 2:29 pm

Re: Children's Taxable Account

That 3 year to 7 year thing applies with respect to statutory heirs, doesn’t it?

Since grandkids are not statutory heirs for their grandparents passing, I think they can get a 1.1 million yen gift each year and never face inheritance tax on it.

Love long, have lots of grandkids, and gift them all money every year.

Since grandkids are not statutory heirs for their grandparents passing, I think they can get a 1.1 million yen gift each year and never face inheritance tax on it.

Love long, have lots of grandkids, and gift them all money every year.

Re: Children's Taxable Account

We found the regular taxable accounts for our kids to be invaluable in saving for college. We started before the J-NISA system began (our kids are now 18-23 years old) and had to use both taxable and J-NISA accounts to get the maximum benefit of the yearly gift tax exemption. Also the J-NISA account did not really allow access to funds when we needed them for our son who started college at age 17 so we were very happy to have the flexibility of both taxable and J-NISA accounts. For investors who are US expats, a dependent child can receive as much as $2300 per year in investment income (this sum changes over time) and have it be taxed at their tax rate which is 0% at this low level so it also helps manage the expat family tax burden.TokyoBoglehead wrote: ↑Fri May 19, 2023 8:37 am It seems the restrictions on Child's taxable accounts makes them a pretty undesirable vehicle. There only real utility is to allow you to invest your "child's money" for them.

Unless your relatives are handing out 1.1 million to each individual to avoid tax, or your child has been gifted money directly for college, there not much reason to use it

Thoughts? Am I missing something here?

-

TokyoBoglehead

- Veteran

- Posts: 791

- Joined: Thu Jul 07, 2022 10:37 am

Re: Children's Taxable Account

Aren't Japanese minors taxable accounts also restricted until age of maturity?TokyoWart wrote: ↑Mon May 22, 2023 7:24 amWe found the regular taxable accounts for our kids to be invaluable in saving for college. We started before the J-NISA system began (our kids are now 18-23 years old) and had to use both taxable and J-NISA accounts to get the maximum benefit of the yearly gift tax exemption. Also the J-NISA account did not really allow access to funds when we needed them for our son who started college at age 17 so we were very happy to have the flexibility of both taxable and J-NISA accounts. For investors who are US expats, a dependent child can receive as much as $2300 per year in investment income (this sum changes over time) and have it be taxed at their tax rate which is 0% at this low level so it also helps manage the expat family tax burden.TokyoBoglehead wrote: ↑Fri May 19, 2023 8:37 am It seems the restrictions on Child's taxable accounts makes them a pretty undesirable vehicle. There only real utility is to allow you to invest your "child's money" for them.

Unless your relatives are handing out 1.1 million to each individual to avoid tax, or your child has been gifted money directly for college, there not much reason to use it

Thoughts? Am I missing something here?

How does this give you more flexibility?

-

TBS

Re: Children's Taxable Account

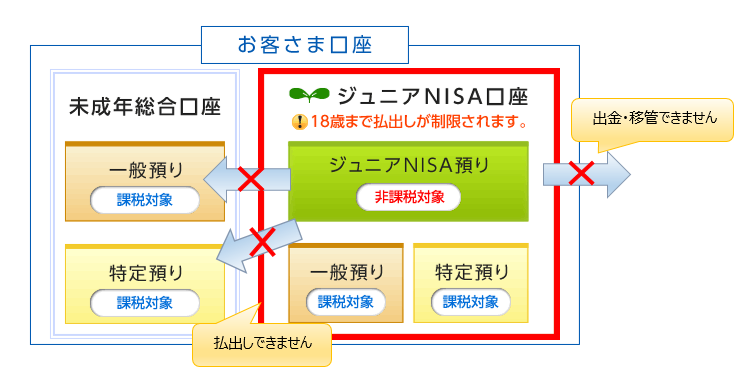

There are no age restrictions on withdrawals from standard minors accounts (未成年総合口座 on the left side of the image).TokyoBoglehead wrote: ↑Mon May 22, 2023 12:29 pm Aren't Japanese minors taxable accounts also restricted until age of maturity?

How does this give you more flexibility?

You may be confusing with Junior NISA accounts, right hand side of the picture, where withdrawals are only permitted from 18+. This includes even if more money is transferred into the Junior NISA account than the Junior NISA contribution limit, in which case it the broker puts it in either a normal or tokutei account on the Junior NISA side. That money is taxable but cannot be withdrawn until 18+, which is just disadvantageous* compared to keeping it in one of the taxable accounts on the 未成年総合口座 where it could still be withdrawn.

* Unless you absolutely want to make sure a child/teenager cannot access the money until they at least hit 18.

Re: Children's Taxable Account

The only restriction we faced on the taxable account was that security orders had to be made by phone or in person (the cheaper online option was not allowed) but that might have been a problem specific to Nomura. We could withdraw funds both by atm or by direct transfer to my son's bank account without any restrictions.Aren't Japanese minors taxable accounts also restricted until age of maturity?

How does this give you more flexibility?

-

TokyoBoglehead

- Veteran

- Posts: 791

- Joined: Thu Jul 07, 2022 10:37 am

Re: Children's Taxable Account

Thank you!TBS wrote: ↑Mon May 22, 2023 2:11 pmThere are no age restrictions on withdrawals from standard minors accounts (未成年総合口座 on the left side of the image).TokyoBoglehead wrote: ↑Mon May 22, 2023 12:29 pm Aren't Japanese minors taxable accounts also restricted until age of maturity?

How does this give you more flexibility?

You may be confusing with Junior NISA accounts, right hand side of the picture, where withdrawals are only permitted from 18+. This includes even if more money is transferred into the Junior NISA account than the Junior NISA contribution limit, in which case it the broker puts it in either a normal or tokutei account on the Junior NISA side. That money is taxable but cannot be withdrawn until 18+, which is just disadvantageous* compared to keeping it in one of the taxable accounts on the 未成年総合口座 where it could still be withdrawn.

* Unless you absolutely want to make sure a child/teenager cannot access the money until they at least hit 18.

I was confusing typical taxable accounts with the strange "taxable" overflow account connect to the Junior Nisa.