The Taxable Income Deduction Value is calculated by the system to produce the necessary Actual Tax Reduction to account for the 10% Residents' Taxes that you have assigned from your Prefecture and Municipality to the Prefecture and Municipality of your Donation and the Tax relief on the Charitable Donation minus Y2000, but the calculated Deduction Amount has the effect of reducing your Total Aggregate Taxable Income, which in turn reduces your Aggregate National Tax by your Marginal Aggregate Tax Rate (33%), Reconstruction Tax Reduction (0.693%), and Residents' Taxes by 10%.

Therefore, the amount of the Calculated Deduction will not match the Furusato Nozei purchase amount. (A saving of 33.21% Taxes + Residents' Tax reduction that matches the 10% Tax reassignment to the beneficiary Prefecture and Municipality of your donation.)

If you run two Tax Calculations, one before deducting the calculated Deduction Value and one after deducting the calculated Deduction Value, you should find that Net Aggregate Tax payable has been reduced by the correct amount.

Was my furusato nozei calculation correct?

Re: Was my furusato nozei calculation correct?

:

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '23 Tax Season.

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '23 Tax Season.

-

TBS

Re: Was my furusato nozei calculation correct?

No, this is incorrect. You've misunderstood how the calculations work, both in this post and in earlier posts in this thread.Tkydon wrote: ↑Mon Jun 27, 2022 7:52 am The Taxable Income Deduction Value is calculated by the system to produce the necessary Actual Tax Reduction to account for the 10% Residents' Taxes that you have assigned from your Prefecture and Municipality to the Prefecture and Municipality of your Donation and the Tax relief on the Charitable Donation minus Y2000, but the calculated Deduction Amount has the effect of reducing your Total Aggregate Taxable Income, which in turn reduces your Aggregate National Tax by your Marginal Aggregate Tax Rate (33%), Reconstruction Tax Reduction (0.693%), and Residents' Taxes by 10%.

Therefore, the amount of the Calculated Deduction will not match the Furusato Nozei purchase amount. (A saving of 33.21% Taxes + Residents' Tax reduction that matches the 10% Tax reassignment to the beneficiary Prefecture and Municipality of your donation.)

...

The calculations for what is taxable income are separate for national tax and for residents tax purposes. The reason is the allowed deductions and their amounts are different for national and residents taxes. Some are the same e.g. the social insurance deduction 社会保険料控除, some are different e.g. the basic 基礎控除 deduction.

The way furusato nozei works for national tax via kakutei shinkoku is the furusato nozei amount minus 2000 yen is allowed as a deduction against taxable income. The national tax saving is then the deduction amount x the marginal tax rate x 1.021 reconstruction tax. This is point (2) of viralriver's earlier post.

The way it works for residents tax is different - it is not a deduction against taxable income. It is a credit against the residents tax due. The residents tax due is calculated from the taxable income without any deduction of the furosato nozei amount. The credit amount is calculated as the furusato nozei amount - 2000 yen - the saving on the national tax. These are the final figures referred to in point (5) of viralriver's earlier post (split proportionally between prefecture and municipality taxes).

This is why when viralriver (and I) calculated the furusato nozei amount using the method in the site linked to by zeroshiki, the figures matched exactly.

The only complications I can envisage is if the kakutei shinkoku furusato nozei deduction moves the tax payer between tax bands, then the calculation in point (2) may need some small adjustments. Or if other donations were declared on the tax return (charitable/political etc.).

But all the information viralriver has received so far from zeroshiki and me is correct, I believe. People can use the method zeroshiki linked to to check the total tax savings equate to the donations amount - 2000 yen. Or if people just want to check that they've not over-donated, look at figure 28 on the national tax return. Assuming no complication such as other donations, manually filled out incorrect tax returns, yada yada.

-

Viralriver

- Veteran

- Posts: 215

- Joined: Sat Aug 29, 2020 5:58 am

Re: Was my furusato nozei calculation correct?

To add to this then - without using a simulator like what Rakuten provides, is there a better way for me to work out what my maximum would be? My salary changes every year (it's known in advance, but fluctuates year on year for reasons I won't get into..) and would be nice to get some more fruit if I can! I think I went significantly under last year if the simulator was correct.

Re: Was my furusato nozei calculation correct?

Why not put in your predicted income for the year into the simulator?

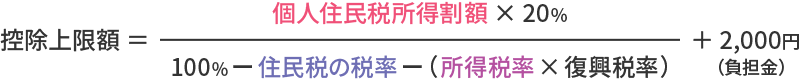

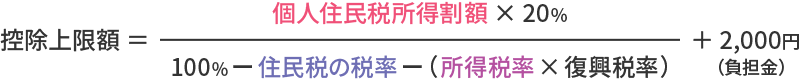

This is the formula according to FuruNavi

This is the formula according to FuruNavi

-

TBS

Re: Was my furusato nozei calculation correct?

Other than hiring an accountant to undertake the calculation, there is not straightforward way to work out the maximum.Viralriver wrote: ↑Tue Jun 28, 2022 1:50 am To add to this then - without using a simulator like what Rakuten provides, is there a better way for me to work out what my maximum would be?

There is a description of how the maximums are set here: http://www.city.wako.lg.jp/home/kurashi ... ouzei.html

It also contains the formula zeroshiki posted. However the difficulty is knowing the 個人住民税所得割額 to put into that formula. To calculate that you need to simulate a full residents tax calculation for your income. Possible, but not straightforward

Look at your previous residence tax bills to gain an idea of how it is done if you are interested. Make sure to cross-check against any changes to residence tax evaluation / deduction rules for this year if you do undertake a calculation.

Making the donations in December is a good idea, as then your income for the year will almost be fixed. It also minimizes the opportunity cost of paying taxes early.

-

Viralriver

- Veteran

- Posts: 215

- Joined: Sat Aug 29, 2020 5:58 am

Re: Was my furusato nozei calculation correct?

Thank you - yeah it's the difficulty in estimating that value which makes this a difficult feat! I have 3 dependents, a fluctuating salary, high percentage of salary paid in stock with some vesting at the end of the year, among other things.

Quick note as I've been looking at my tax slip again today. On the left page at the bottom it lists 寄附金税額控除額 as 区民税 x 都民税 y. Looking on the right page within the 区民税 section, I have 税額控除額 = x + 1500, and for 都民税 I have 税額控除額 = y + 1000. This gives a total of 2,500 JPY in addition to the actual donations. Is it possible that the "price" for furusato increased?

Quick note as I've been looking at my tax slip again today. On the left page at the bottom it lists 寄附金税額控除額 as 区民税 x 都民税 y. Looking on the right page within the 区民税 section, I have 税額控除額 = x + 1500, and for 都民税 I have 税額控除額 = y + 1000. This gives a total of 2,500 JPY in addition to the actual donations. Is it possible that the "price" for furusato increased?

-

TBS

Re: Was my furusato nozei calculation correct?

The +1500 and +1000 will likely be your 調整控除額. It is something separate from furusato nozei. It is a small residence tax credit that was introduced from 2007 upon changes to the basic deduction amounts between national and residence tax. There's some info on it here:Viralriver wrote: ↑Wed Jun 29, 2022 4:34 am Quick note as I've been looking at my tax slip again today. On the left page at the bottom it lists 寄附金税額控除額 as 区民税 x 都民税 y. Looking on the right page within the 区民税 section, I have 税額控除額 = x + 1500, and for 都民税 I have 税額控除額 = y + 1000. This gives a total of 2,500 JPY in addition to the actual donations. Is it possible that the "price" for furusato increased?

https://www.town.hinode.tokyo.jp/0000000519.html

https://biz.moneyforward.com/words/174/

-

Viralriver

- Veteran

- Posts: 215

- Joined: Sat Aug 29, 2020 5:58 am

Re: Was my furusato nozei calculation correct?

So mamy tidbits of information and I'm still far from knowing everything there is about taxes here haha.

Thanks again, your knowledge is incredibly helpful!

Thanks again, your knowledge is incredibly helpful!

-

Viralriver

- Veteran

- Posts: 215

- Joined: Sat Aug 29, 2020 5:58 am

Re: Was my furusato nozei calculation correct?

Hi @zeroshiki, do you have any idea if this calculation has changed this year or not?zeroshiki wrote: ↑Sat Jun 25, 2022 1:59 pm

Hmm.. so it seems like the process to check how much furusato nozei reduced your tax bill is different if you did kakutei shinkoku.

So those fields seem to just be a part of your deduction. You then have to add the value of: ("total donation" - 2000) x income tax rate x 1.021 to it.

https://furu-sato.com/magazine/11491/

I performed the same calculation and got a value higher than what I had actually donated!

Re: Was my furusato nozei calculation correct?

The simulator here is very good, if you can figure it out!

https://kaikei7.com/furusato_nouzei_keisan/

The simulator above gives the best picture I've seen, but the outputs are only as good as the inputs.

The simulator above gives the best picture I've seen, but the outputs are only as good as the inputs.

None of this applies if you do one stop, which is much simpler.

https://kaikei7.com/furusato_nouzei_keisan/

This is the biggest problem with Furusato Nozei. You have to do a full tax return to know the optimal donation amount, but you can't do that until it's already too late to donate.Viralriver wrote: ↑Tue Jun 28, 2022 1:50 amMy salary changes every year (it's known in advance, but fluctuates year on year for reasons I won't get into..)

None of this applies if you do one stop, which is much simpler.

Last edited by adamu on Sun Dec 24, 2023 5:55 am, edited 1 time in total.