1. Yes, the hedged ETF tracks the returns of the stocks in their own currencies, but most of the behavior was dictated by the JPY weakening relative to the other currencies, mostly USD and EUR, so this nuance changes nothing.

2. The debate about the definition of volatility again changes nothing in the final conclusion. Call it "divergence" if you want, and replace "volatility" with "divergence" in my final conclusion and then tell me where is wrong then.

3. You say "it is wrong to characterize investing in MSCI World as conservative". Well, another matter of opinions, but in my opinion when it comes to stock investing, MSCI World is conservative. Call it as you want, the conclusion does not change.

4. You say it is wrong to say that "the effect of currency fluctuations is the bigger risk, when in fact over the long term it is the opposite that is true." Again, go to the chart I shared, and tell me if 50% is bigger or smaller than 5%.

Does it make sense to continue with the same strategy with this JPY/USD rate?

-

TBS

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

It changes your interpretation above because you were calling the 5% difference tracking error, when in fact is related to the curves fundamentally representing different things. It was an attempt to make you stop and rethink - realize you are not as on top of this discussion as you think, and that you keep misunderstanding the nuances of the points being made

Your conclusion is wrong because it focuses on a narrow time window (and one where hedging would have been highly detrimental for Japanese investors). You are making an argument from that small amount of data to conclude that hedging is a worthwhile cost to bear in exchange for a risk reduction benefit. However long term historical data shows hedging only offers a modest risk reduction at best, and as I and others have pointed out, this is not really worthwhile enough to offset the structural costs and inefficiencies of hedging for JP-based non-Japanese investors.alberto wrote: ↑Fri Oct 27, 2023 4:23 pm 2. The debate about the definition of volatility again changes nothing in the final conclusion. Call it "divergence" if you want, and replace "volatility" with "divergence" in my final conclusion and then tell me where is wrong then.

3. You say "it is wrong to characterize investing in MSCI World as conservative". Well, another matter of opinions, but in my opinion when it comes to stock investing, MSCI World is conservative. Call it as you want, the conclusion does not change.

4. You say it is wrong to say that "the effect of currency fluctuations is the bigger risk, when in fact over the long term it is the opposite that is true." Again, go to the chart I shared, and tell me if 50% is bigger or smaller than 5%.

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

No problem with nuances, but I think it's better to stay on the main debate if the nuances don't change the conclusion at all. You say I'm focusing on a narrow time window, but that doesn't change the conclusion. If 2 years is narrow or wide is again a matter of opinion, but the reality is that a huge deviation from the intended investment was actually produced. You talk about "structural costs and inefficiencies" of hedging, but in the chart I shared those "costs and inefficiencies" were one order of magnitude smaller than the impact of the JPY fluctuation, which is what you minimize with hedging.

-

TBS

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

Nobody is saying that hedging isn't effective at removing the impact of the JPY/USD fluctuation - which is all that your conclusion is saying. So if that's what you think the main debate is here, fair enough no disagreement.alberto wrote: ↑Fri Oct 27, 2023 4:55 pm No problem with nuances, but I think it's better to stay on the main debate if the nuances don't change the conclusion at all. You say I'm focusing on a narrow time window, but that doesn't change the conclusion. If 2 years is narrow or wide is again a matter of opinion, but the reality is that a huge deviation from the intended investment was actually produced. You talk about "structural costs and inefficiencies" of hedging, but in the chart I shared those "costs and inefficiencies" were one order of magnitude smaller than the impact of the JPY fluctuation, which is what you minimize with hedging.

But I thought the main debate here was "does it make sense to hedge"?

-

TBS

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

This hits on the core of your misunderstanding. The intention of investing in global equities is not to seek the exact returns of those equities in their respective home currencies. It is to provide global diversification - "the only free lunch in investing".

You need to stop placing the returns in the home countries in the privileged position, and a priori considering currency fluctuations as inherently bad. Instead you need to compare the risk/return properties, investment costs and practicalities of unhedged/hedged products for a JP-investor on an equal footing, then decide which is best.

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

Yes, exactly, now you hit the core of the debate! The intention behind global diversification ("the only free lunch in investing") should be precisely to look for the returns of those global equities only, in their respective home currencies.

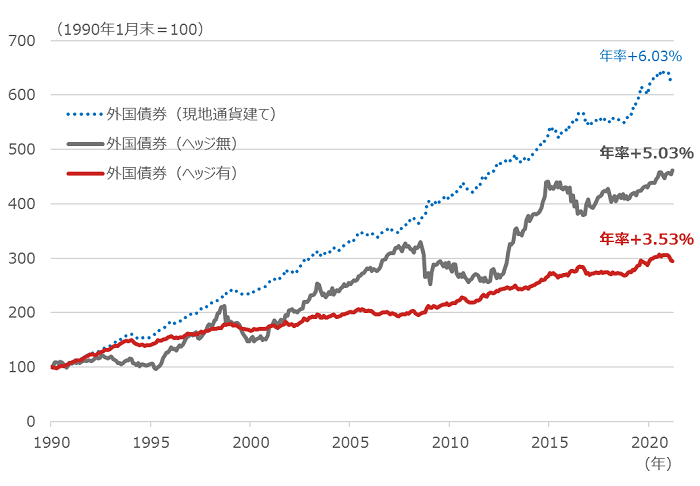

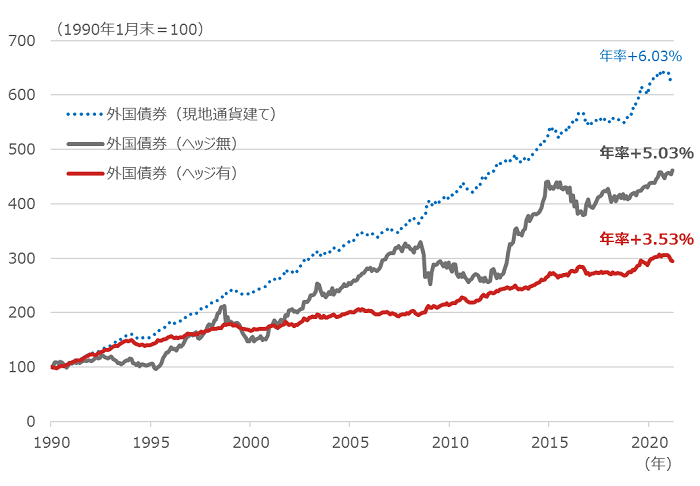

Because the ideal behavior behind this conservative long-term investment is that the diversified stocks go up and currency stays flat, as in the figure:

Of course, the real behavior can be different from the ideal one, and then you use some strategy to try to get as close to the ideal behavior as possible.

With stocks, buying periodically typically gives you an averaged cost, and the volatility resolves eventually in both directions giving you the expected bullish behavior.

With currencies, the volatility can be huge (as we just experienced in Japan) and can even never resolve going in one direction only (as someone commented in this thread), and then we have an instrument called currency hedge, especially suited for countries with big currency fluctuation if you want to minimize this effect and get a more ideal behavior.

Because the ideal behavior behind this conservative long-term investment is that the diversified stocks go up and currency stays flat, as in the figure:

Of course, the real behavior can be different from the ideal one, and then you use some strategy to try to get as close to the ideal behavior as possible.

With stocks, buying periodically typically gives you an averaged cost, and the volatility resolves eventually in both directions giving you the expected bullish behavior.

With currencies, the volatility can be huge (as we just experienced in Japan) and can even never resolve going in one direction only (as someone commented in this thread), and then we have an instrument called currency hedge, especially suited for countries with big currency fluctuation if you want to minimize this effect and get a more ideal behavior.

-

Tsumitate Wrestler

- Veteran

- Posts: 369

- Joined: Wed Oct 04, 2023 1:06 pm

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

I think the missing part of the puzzle here is understating the significance of "fee and cost drag".

Ignore currency for now.

Now the term we use to characterize the costs of currency hedging isn't material, so let's refer to it as a "fee".

This will errode your earnings slowly over time costing you millions of yen. The compounding effect, the miracle of routine index investing, is dampened.

This is not too similiar from those who choose to buy covered call ETFs. They are capping their potential profits in exchange for the appearance of more stable returns.

Dividend investors make a somewhat similiar mistake by avoiding growth companies and tax-efficiency in search of cashflow.

.....

These are emotional decision that some investors choose to make, but it is not a decision recommended by professionals and not supported by the data.

All that is fine. Just be cautious with estimating future returns and be conservative with retirement planning.

We do all want you to be right with your bet for the record....a rising yen would certainly make me happy.

Ignore currency for now.

Now the term we use to characterize the costs of currency hedging isn't material, so let's refer to it as a "fee".

This will errode your earnings slowly over time costing you millions of yen. The compounding effect, the miracle of routine index investing, is dampened.

This is not too similiar from those who choose to buy covered call ETFs. They are capping their potential profits in exchange for the appearance of more stable returns.

Dividend investors make a somewhat similiar mistake by avoiding growth companies and tax-efficiency in search of cashflow.

.....

These are emotional decision that some investors choose to make, but it is not a decision recommended by professionals and not supported by the data.

All that is fine. Just be cautious with estimating future returns and be conservative with retirement planning.

We do all want you to be right with your bet for the record....a rising yen would certainly make me happy.

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

I’m out. We can lead a horse to water but we can’t make it drink.

-

sutebayashi

- Veteran

- Posts: 628

- Joined: Tue Nov 07, 2017 2:29 pm

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

I was trying to find some articles by Japanese folks in this topic, to see if I could find any in favour of hedged offerings.

I did not search so hard, but so far found none, but when reading this one from last year had a few thoughts:

https://media.monex.co.jp/articles/amp/20454

1) this was a topic last year, and here we are a year later, and the yen is down further again. Next year might be different… but who knows

2) although the yen is down now, it did have some reprieve during the time, rebounding to better than 130 to the greenback before returning to a period of decline again.

But then, what about the exit strategy? Let’s say that you buy a hedged fund, and by good fortune the value of the yen recovers to 120 from here, about a 20% increase. Great!

Then what are you going to do?

Keep the hedged fund, and even keep buying more of it perhaps?

The basics of long term investment for me are, diversification of assets through index investing, diversification of time through regular tsumitate DCA style purchases, and keeping costs as low as possible for the asset in question.

I did not search so hard, but so far found none, but when reading this one from last year had a few thoughts:

https://media.monex.co.jp/articles/amp/20454

1) this was a topic last year, and here we are a year later, and the yen is down further again. Next year might be different… but who knows

2) although the yen is down now, it did have some reprieve during the time, rebounding to better than 130 to the greenback before returning to a period of decline again.

But then, what about the exit strategy? Let’s say that you buy a hedged fund, and by good fortune the value of the yen recovers to 120 from here, about a 20% increase. Great!

Then what are you going to do?

Keep the hedged fund, and even keep buying more of it perhaps?

The basics of long term investment for me are, diversification of assets through index investing, diversification of time through regular tsumitate DCA style purchases, and keeping costs as low as possible for the asset in question.

Re: Does it make sense to continue with the same strategy with this JPY/USD rate?

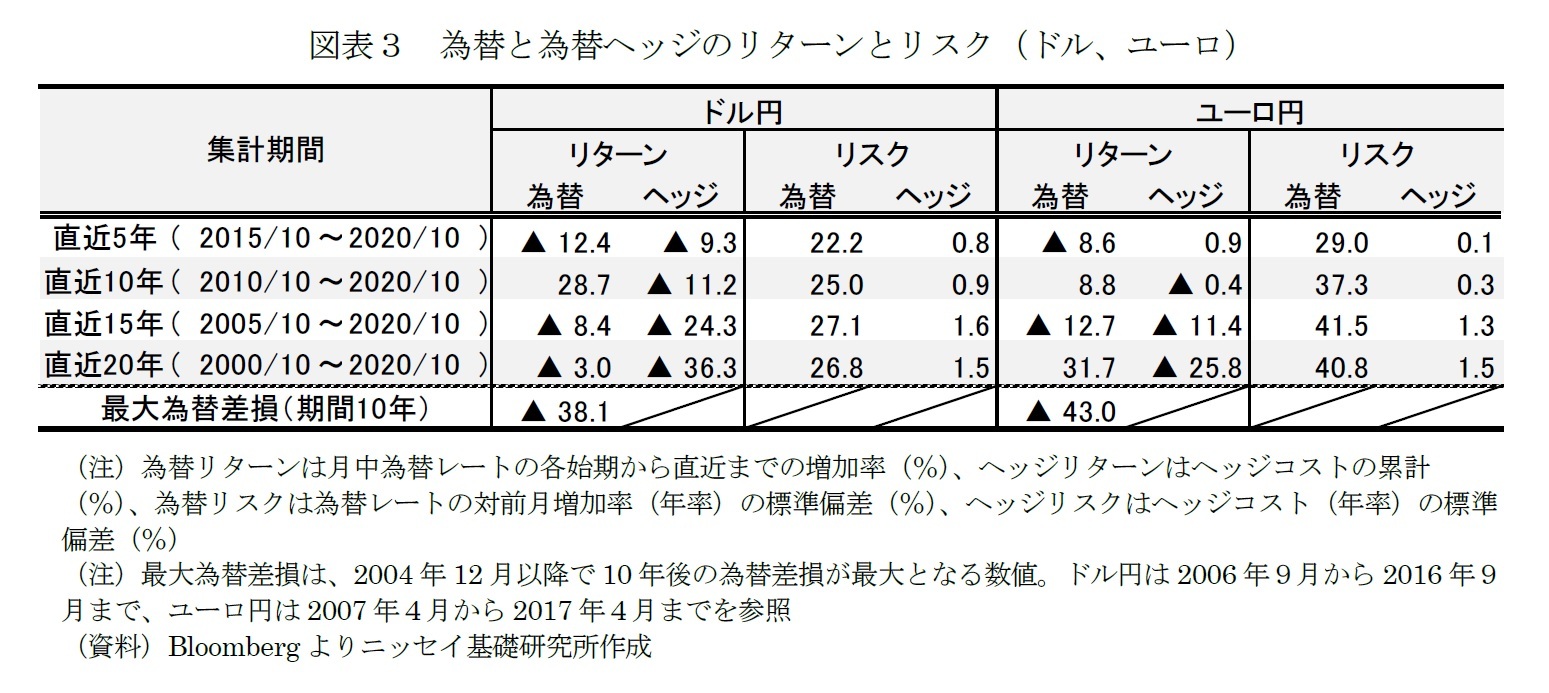

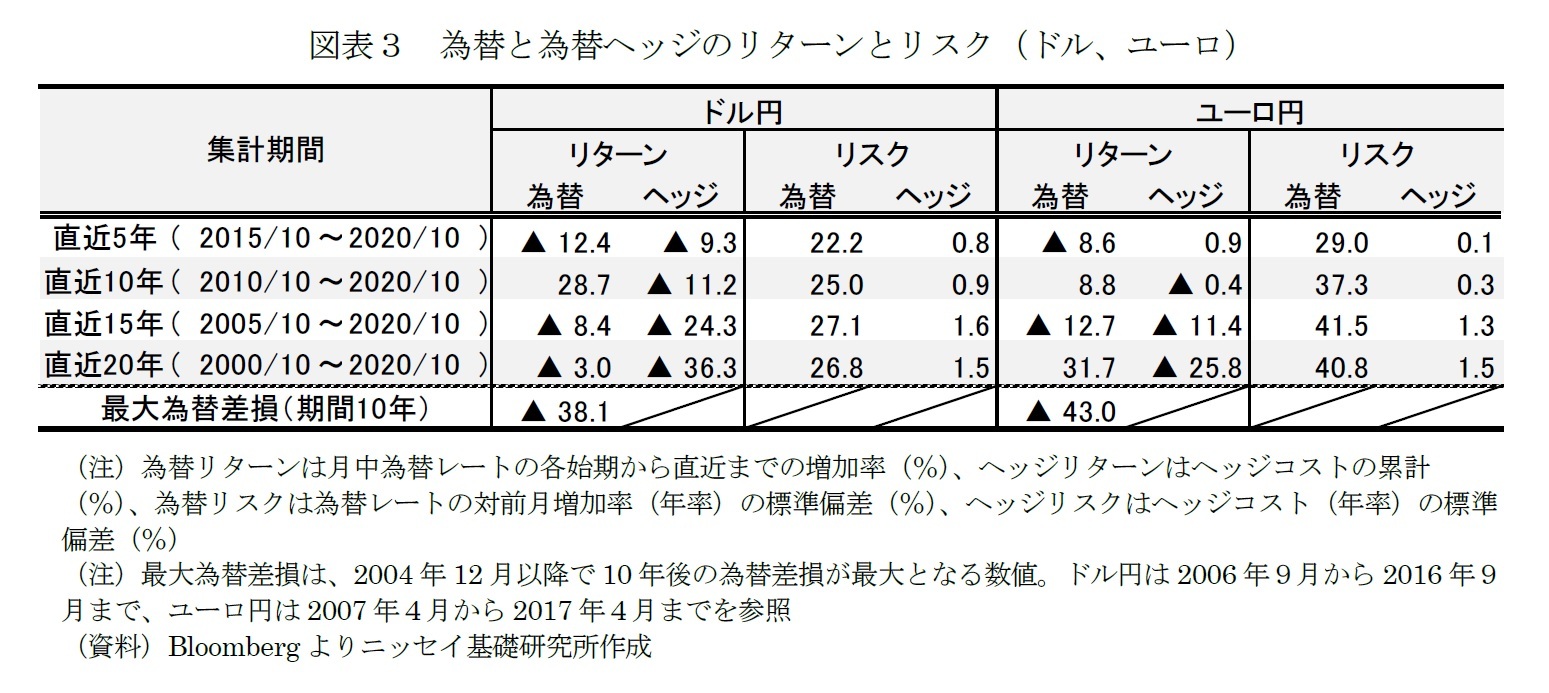

Here's Japanese research on it. Investing in an index funds (or as OP loves using MSCI Kokusai, Developed - Japan) carries with it currency risk but as currency rates bounce up and down, the hedge costs tend to be a drag on the growth of the fund itself.

https://www.nli-research.co.jp/report/d ... 0?site=nli

A dollar hedge bought in 2000 would be 36% down in 2020. Ouch.

Basically even if you have perfect foresight and are GUARANTEED that the yen will appreciate and thus making your bet a 'winner' the numbers still show that over the long term, the hedge cost is a massive drag on your returns.

Here is literally a link from daiwa NEXTFUNDS site saying for long term investing, non-hedged is better (they compared using a bond index)

https://nextfunds.jp/semi/article709.html

https://www.nli-research.co.jp/report/d ... 0?site=nli

A dollar hedge bought in 2000 would be 36% down in 2020. Ouch.

Basically even if you have perfect foresight and are GUARANTEED that the yen will appreciate and thus making your bet a 'winner' the numbers still show that over the long term, the hedge cost is a massive drag on your returns.

Here is literally a link from daiwa NEXTFUNDS site saying for long term investing, non-hedged is better (they compared using a bond index)

https://nextfunds.jp/semi/article709.html