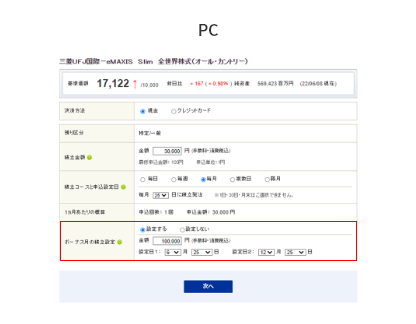

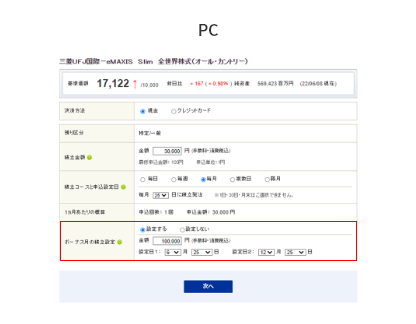

No, the maximum is 100,000 yen a month. There is a 'bonus' payment feature you can use if you are not going to fill your tsumitate allowance (if you started late or your monthly payment is less than 100,000 yen) but you can't set the monthly payment above 100,000.

NISA General Questions | SBI

- RetireJapan

- Site Admin

- Posts: 4426

- Joined: Wed Aug 02, 2017 6:57 am

- Location: Sendai

- Contact:

Re: NISA General Questions | SBI

English teacher and writer. RetireJapan founder. Avid reader.

eMaxis Slim Shady

eMaxis Slim Shady

Re: NISA General Questions | SBI

Much appreciated.RetireJapan wrote: ↑Wed Feb 28, 2024 8:09 amNo, the maximum is 100,000 yen a month. There is a 'bonus' payment feature you can use if you are not going to fill your tsumitate allowance (if you started late or your monthly payment is less than 100,000 yen) but you can't set the monthly payment above 100,000.

Re: NISA General Questions | SBI

If you utilise the growth portion too, you can tsumitate up to ¥300k/mo. It's confusing because tsumitate is both the name of the tsumitate portion, and a term meaning regular investments. There's no reason you can't set up regular investments into the growth portion, too, for a maximum of ¥300k/mo.RetireJapan wrote: ↑Wed Feb 28, 2024 8:09 am the maximum is 100,000 yen a month. There is a 'bonus' payment feature you can use if you are not going to fill your tsumitate allowance (if you started late or your monthly payment is less than 100,000 yen) but you can't set the monthly payment above 100,000.

- styxomaniac

- Regular

- Posts: 61

- Joined: Sun Dec 11, 2022 9:15 am

Re: NISA General Questions | SBI

You can go to your account settings to change your transaction password. There is also an option to reset it. Just remember that the transaction password is different from your login password.I'm stuck on the step after this one (Step 3. 入力内容の確認) where it asks for a transaction password. Is it not the same password we log into our account with? Or do I need to make a specific password?

Re: NISA General Questions | SBI

Thank you.adamu wrote: ↑Wed Feb 28, 2024 11:24 am If you utilise the growth portion too, you can tsumitate up to ¥300k/mo. It's confusing because tsumitate is both the name of the tsumitate portion, and a term meaning regular investments. There's no reason you can't set up regular investments into the growth portion, too, for a maximum of ¥300k/mo.

Am I correct to understand that the "growth portion" you speak of applies to the so-called "spot purchase" allocation, the one with the 2.4 million yen cap?

I am trying to target here the 1.2 million tsumitate allocation. Would you know how to make that 1-time "bonus" payment in that yearly allocation?

Again, thank you.

Re: NISA General Questions | SBI

Yes.

It is done at the same time as you place the tsumitate order. You set the regular and bonus amounts and relevant dates. You can set up to two bonus days.

https://go.sbisec.co.jp/prd/fund/bonus_ ... index.html

Re: NISA General Questions | SBI

Got it.adamu wrote: ↑Wed Feb 28, 2024 9:29 pmYes.

It is done at the same time as you place the tsumitate order. You set the regular and bonus amounts and relevant dates. You can set up to two bonus days.

https://go.sbisec.co.jp/prd/fund/bonus_ ... index.html

Thank you. Good karma to you.

Re: NISA General Questions | SBI

I'm a little confused. I have 400 shares in Japan Tobacco distributed as follows in my SBI account:

Shares (Cash / NISA Deposits (Growth Investment Quota)) / 株式(現物/NISA預り(成長投資枠))

Japan Tobacco 100 shares

Shares (in kind/formerly NISA) / 株式(現物/旧NISA預り)

Japan Tobacco 300 shares

Today I checked my account to see if I have received the dividends yet from these investments. I was surprised to see this:

It appears that my dividend for 100 shares of JT under the "New NISA" got taxed at the standard 20.315% rate. Maybe I missed something about how the New NISA works but I thought it was tax free? Hopefully someone can explain.

Incidentally, I have no idea why the deposit date is in the future. The money is already showing in my SBI account balance. Presumably it was deposited on Friday the 22nd.

Shares (Cash / NISA Deposits (Growth Investment Quota)) / 株式(現物/NISA預り(成長投資枠))

Japan Tobacco 100 shares

Shares (in kind/formerly NISA) / 株式(現物/旧NISA預り)

Japan Tobacco 300 shares

Today I checked my account to see if I have received the dividends yet from these investments. I was surprised to see this:

It appears that my dividend for 100 shares of JT under the "New NISA" got taxed at the standard 20.315% rate. Maybe I missed something about how the New NISA works but I thought it was tax free? Hopefully someone can explain.

Incidentally, I have no idea why the deposit date is in the future. The money is already showing in my SBI account balance. Presumably it was deposited on Friday the 22nd.

- RetireJapan

- Site Admin

- Posts: 4426

- Joined: Wed Aug 02, 2017 6:57 am

- Location: Sendai

- Contact:

Re: NISA General Questions | SBI

Are you sure the 100 shares are actually in your New NISA account? Doesn't seem like it from the screenshot.Teflon wrote: ↑Sat Mar 23, 2024 9:36 am I'm a little confused. I have 400 shares in Japan Tobacco distributed as follows in my SBI account:

Shares (Cash / NISA Deposits (Growth Investment Quota)) / 株式(現物/NISA預り(成長投資枠))

Japan Tobacco 100 shares

Shares (in kind/formerly NISA) / 株式(現物/旧NISA預り)

Japan Tobacco 300 shares

Today I checked my account to see if I have received the dividends yet from these investments. I was surprised to see this:

It appears that my dividend for 100 shares of JT under the "New NISA" got taxed at the standard 20.315% rate. Maybe I missed something about how the New NISA works but I thought it was tax free? Hopefully someone can explain.

Incidentally, I have no idea why the deposit date is in the future. The money is already showing in my SBI account balance. Presumably it was deposited on Friday the 22nd.

English teacher and writer. RetireJapan founder. Avid reader.

eMaxis Slim Shady

eMaxis Slim Shady

Re: NISA General Questions | SBI

Yeah, good question! I'm pretty sure I selected NISA when I bought it, and it shows up under the NISA section of my portfolio. The order history for this transaction appears to be NISA:RetireJapan wrote: ↑Sat Mar 23, 2024 10:02 am Are you sure the 100 shares are actually in your New NISA account? Doesn't seem like it from the screenshot.

Maybe I failed to select something?